LoanFrame Supply Chain Finance

- Size: 16.00M

- Versions: 4.2.2

- Updated: Aug 09,2024

Introduction

LoanFrame Supply Chain Finance is an innovative app that revolutionizes the way businesses in the supply chain industry access financing. This easy-to-use platform simplifies the entire process by connecting corporates, vendors, distributors, and retailers to a wide range of top-rated lenders. With the app, businesses can quickly and conveniently secure fast, affordable, and flexible working capital solutions tailored to their unique needs. Whether you are a small vendor or a multinational corporation, LoanFrame's extensive lender network ensures that you can find the perfect financing option that meets your requirements. Say goodbye to lengthy paperwork and endless waiting times – the app has got you covered.

Features of LoanFrame Supply Chain Finance:

Access to a Diverse Network of Lenders:

The game provides access to a vast network of supply chain finance solutions. This means that businesses can explore multiple options and choose the lender and working capital solution that best suits their needs. With a diverse range of lenders, businesses can find competitive rates and flexible terms.

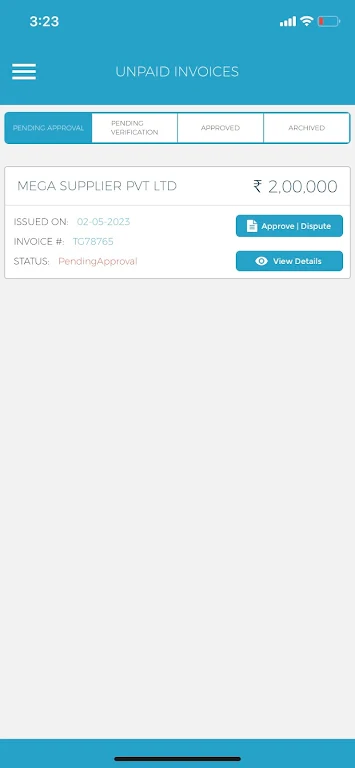

Digitized and Streamlined Process:

The game is digitized, making the application and approval process faster and more efficient. Businesses can save time and effort by submitting their information online and receiving loan offers within a short timeframe. This streamlined process ensures that businesses can secure the working capital they need without any unnecessary delays.

Tailored Solutions for Different Sectors and Customer Profiles:

Loan Frame understands that different businesses have unique requirements. Their platform offers customized working capital solutions for various sectors and customer profiles. Whether it's a small vendor or a large retailer, Loan Frame can provide tailored solutions that address specific needs and challenges.

Affordable and Flexible Working Capital Options:

With Loan Frame, businesses can access affordable and flexible working capital options. They offer competitive interest rates and repayment terms that can be customized to match the cash flow of the business. This ensures that businesses can manage their finances effectively and utilize the working capital to grow and thrive.

FAQs:

How long does the application process take?

Loan Frame's digitized platform enables a quick and efficient application process. Typically, businesses can expect to receive loan offers within a few days of submitting their application. The exact time may vary depending on the complexity of the request and the lenders' response time.

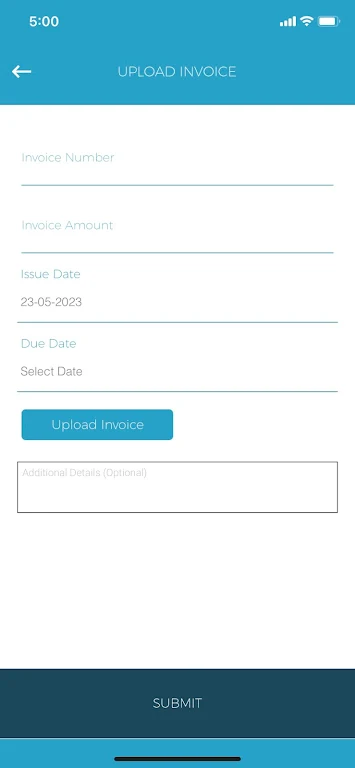

What documents are required for the application?

To apply for a supply chain finance loan, businesses will need to provide basic company information, financial statements, and other relevant documents. Loan Frame makes it easy for businesses to upload and submit these documents electronically, reducing paperwork and saving time.

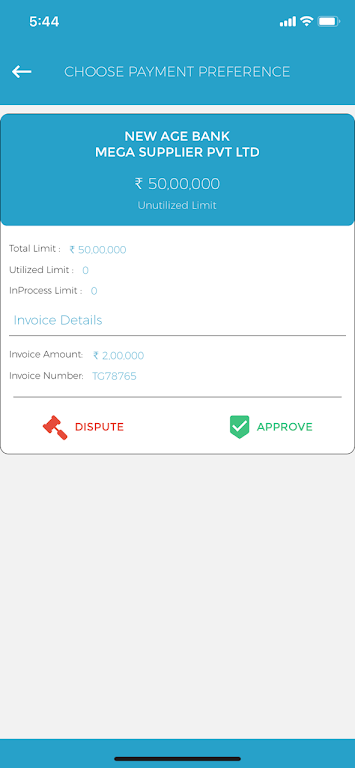

Can businesses choose their preferred lender?

Yes, Loan Frame's multi-lender marketplace allows businesses to compare and select their preferred lender. The platform displays loan offers from different lenders, along with the terms and conditions, allowing businesses to make an informed decision that aligns with their needs and preferences.

Conclusion:

LoanFrame Supply Chain Finance offers a range of attractive points for businesses in need of supply chain finance. With access to a diverse network of lenders, digitized and streamlined processes, tailored solutions, and affordable working capital options, Loan Frame provides businesses with the tools they need to optimize their cash flow and drive growth. Whether it's a small vendor or a large retailer, Loan Frame's comprehensive marketplace ensures that businesses can find the right financing solution to meet their unique requirements. Say goodbye to traditional and time-consuming loan processes – Loan Frame is here to revolutionize the way supply chain finance is accessed and managed.

Information

- Rating: 4.4

- Votes: 217

- Category: Finance

- Language:English

- Developer: Loan Frame Technologies Pte Ltd.

- Package Name: com.loanframemobile

You May Also Like

Finance

-

Drei Kundenzone

Size: 4.89MB

Download -

Hello Bank!

Size: 114.20MB

Download -

Passo

Size: 43.40MB

Download -

Account Manager

Size: 5.61MB

Download -

World Mobil

Size: 107.60MB

Download -

Careers24

Size: 3.80MB

Download

Recommended

More+-

레전드 라이더

레전드 라이더

레전드 라이더 app is a game-changer in the world of deliveries, offering fast and precise services to get goods, food, and more to their destination with ease. With real-time location tracking, users are connected to the nearest driver for quick service and accurate estimated arrival times. This app ensures efficient communication between customers and drivers, allowing for seamless service fulfillment. Even when running in the background, the app provides valuable functions such as real-time delivery status notifications and emergency support. Experience the convenience and reliability of 레전드 라이더 as it revolutionizes the way we handle deliveries.

-

SLB Delivery Mgr

SLB Delivery Mgr

Say goodbye to the complexities of ordering in the oil field industry with SLB Delivery Mgr. This innovative app makes it easier than ever for employees to place orders on behalf of customers, ultimately improving efficiency and customer satisfaction. With features that allow for easy order management, order tracking, and seamless communication, SLB Delivery Mgr streamlines operations and keeps everyone in the loop. Say hello to a more streamlined procurement process with SLB Delivery Mgr at your fingertips.

-

Hello Bank!

Hello Bank!

With the Hello bank! App, managing your finances has never been easier! Keep track of your current accounts and cards, purchase new products with just a few taps, set reminders for important deadlines, and access all your documents on the go. The app's intuitive design and user-friendly interface make navigating through your daily financial tasks a breeze. Plus, with the added convenience of Fingerprint access for compatible devices, you can enjoy a seamless and secure banking experience. Say hello to a smarter way of managing your money with the Hello bank! App.

-

BankID security app

BankID security app

BankID Security App is a vital tool in maintaining secure access to personal identification on mobile devices. Developed as part of the Mobile BankID system, this app is supported by leading financial institutions such as Danske Bank, Nordea, and Swedbank. With BankID Security App, users can securely authenticate their identity while accessing a wide range of services provided by participating organizations. Compatible with Android 6 and newer devices, this app ensures reliable protection for users’ personal information. For more information on how BankID Security App can enhance your mobile security experience, visit www.bankid.com/rp/info.

-

WikiFX-Broker Regulatory APP

WikiFX-Broker Regulatory APP

WikiFX-Broker Regulatory APP is your go-to app for all things forex trading. With up-to-date information on over 40,000 brokers, including regulation, license, and risk exposure, you can rest assured that you are making informed decisions. The app also offers real-time market data, news updates, and a social component where you can interact with other traders. Whether you are a seasoned trader or just starting out, WikiFX has got you covered. And with features like field surveys and relationship diagrams, you can easily spot and avoid fake brokers. Download the app today and take your trading to the next level.

-

World Mobil

World Mobil

World Mobil is a versatile app that offers a wide range of features to make your financial transactions easier and more convenient. With the Opportunities menu, you can easily access campaigns and special offers, track your earnings, and participate in campaigns with just a tap. The My Earnings menu allows you to manage your credit card transactions, view earned points, and transfer points between cards. The World PAY menu enables seamless purchases through QR code or NFC mobile payment, making transactions effortless. With a global deployment strategy focusing on phased rollouts and localized solutions, World Mobil is committed to providing tailored solutions for customers worldwide. Additionally, features like My Cards, Card Tracking, and My Profile offer further customization and control. Download World Mobil now and experience a new level of financial convenience tailored to your needs.

Popular

-

127.40MB

-

22.02MB

-

36.60MB

-

52.20MB

-

63.40MB

-

727.70MB

-

8112.40MB

-

910.50MB

-

1012.14MB

VPN

VPN

Comments