TachyLoans - Instant Loan for Education

- Size: 5.00M

- Versions: 1.62

- Updated: Sep 21,2024

Introduction

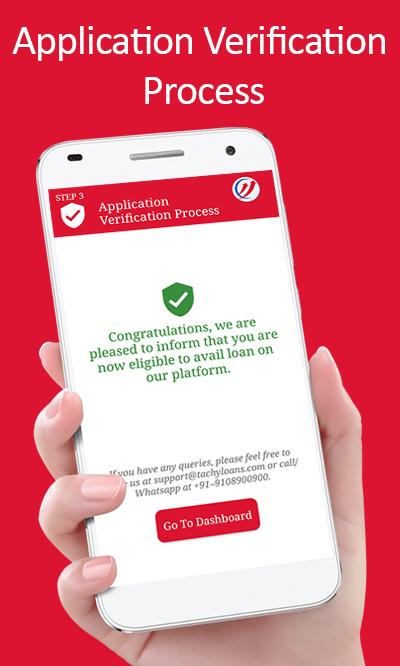

Look no further than TachyLoans - Instant Loan for Education - the leading education loan provider in India. With TachyLoans, you can get an instant collateral-free loan online, with interest rates starting at an unbelievable 11.50%. Our team of core bankers and technological experts have created a complete digital experience, from application to disbursement, meaning you don't even have to leave your home to complete the process. With simpler processes, swifter approvals, and a smarter way of borrowing, TachyLoans is the perfect solution for your education financing needs. With flexible EMI tenures, loan amounts ranging from ₹20,000 to 5 lakhs, and zero collateral security requirements, we make it easy for you to get the funds you need. Download our Education Loan app now and start your journey towards a brighter future!

Features of TachyLoans - Instant Loan for Education:

Flexible EMI Tenures: With TachyLoans, borrowers have the option to select a repayment period that suits their financial situation. They can choose from a range of EMI tenures, from 6 to 36 months, allowing for better financial planning and management.

Loan Amounts: TachyLoans offers loan amounts ranging from ₹20,000 to 5 lakhs, ensuring that borrowers can find the right amount to cover their education expenses, whether it's for school fees, professional certification, or skill development courses.

Collateral-Free Loan: TachyLoans eliminates the need for collateral security, making it easier and more accessible for individuals to get the funds they need for educational purposes. This feature allows borrowers to apply for a loan without the worry of providing collateral.

Direct Disbursement: TachyLoans simplifies the borrowing process by directly disbursing the loan amount to the school or educational institute. This not only streamlines the process but also ensures that the funds are used for their intended purpose.

Easy Repayment: TachyLoans offers easy repayment options through NACH (National Automated Clearing House), making it convenient for borrowers to repay their loans. This automated process reduces the hassle of manual repayments and ensures timely payments.

Wide Service Network: TachyLoans is available in more than 100 cities across India, making it accessible to a wide range of borrowers. Whether you're located in a major city or a smaller town, TachyLoans aims to provide its services to as many individuals as possible.

Tips for Users:

Research and Compare: Before applying for a loan, take the time to research and compare different loan providers and their offerings. Look for competitive interest rates, flexible repayment options, and customer reviews to ensure you're making the right choice.

Prepare necessary documents: To expedite the loan application process, gather all the required documents in advance. This includes your PAN card, current address proof, selfie, bank statements, and payslips. Having these documents ready will make the application process smoother and faster.

Evaluate repayment capacity: Before taking out a loan, carefully evaluate your repayment capacity. Consider your monthly income, expenses, and other financial obligations to determine how much you can comfortably repay each month. This will prevent any financial strain and ensure timely repayments.

Conclusion:

With flexible EMI tenures, loan amounts tailored to educational needs, and a collateral-free loan option, TachyLoans proves to be a reliable and efficient solution. The direct disbursement to educational institutes and easy repayment through NACH further simplify the borrowing process. With a wide service network and a commitment to data security and privacy, TachyLoans - Instant Loan for Education aims to provide a seamless and secure loan experience for individuals across India. Download the Education Loan app now and embark on your learning journey with ease.

Information

- Rating: 4.1

- Votes: 260

- Category: Finance

- Language:English

- Developer: FinMomenta Pvt Ltd

- Package Name: com.tachyloans

You May Also Like

Education Read

-

EBSi 고교강의

Size: 19.05MB

Download -

UnitedMasters

Size: 41.04MB

Download -

Canvas Parent

Size: 3.85MB

Download -

Class 11 NCERT Solutions Hindi

Size: 20.00MB

Download -

Kids Coloring Book

Size: 14.00MB

Download -

নামাজ শিক্ষা বই ~ Namaj Sikkha

Size: 26.00MB

Download

-

Cebuano Bible

Size: 25.90MB

Download -

Santa Biblia TLA

Size: 16.50MB

Download -

ADJA

Size: 22.40MB

Download -

Hindi Bible (Pavitra Bible)

Size: 36.92MB

Download -

Kitapyurdu

Size: 30.78MB

Download -

Simple Analog Clock [Widget]

![Simple Analog Clock [Widget] APK](https://image.chaciba.com/upload/202506/12/abc22wFK9cqDPBQ.png)

Size: 1.58MB

Download

Recommended

More+-

레전드 라이더

레전드 라이더

레전드 라이더 app is a game-changer in the world of deliveries, offering fast and precise services to get goods, food, and more to their destination with ease. With real-time location tracking, users are connected to the nearest driver for quick service and accurate estimated arrival times. This app ensures efficient communication between customers and drivers, allowing for seamless service fulfillment. Even when running in the background, the app provides valuable functions such as real-time delivery status notifications and emergency support. Experience the convenience and reliability of 레전드 라이더 as it revolutionizes the way we handle deliveries.

-

SLB Delivery Mgr

SLB Delivery Mgr

Say goodbye to the complexities of ordering in the oil field industry with SLB Delivery Mgr. This innovative app makes it easier than ever for employees to place orders on behalf of customers, ultimately improving efficiency and customer satisfaction. With features that allow for easy order management, order tracking, and seamless communication, SLB Delivery Mgr streamlines operations and keeps everyone in the loop. Say hello to a more streamlined procurement process with SLB Delivery Mgr at your fingertips.

-

Hello Bank!

Hello Bank!

With the Hello bank! App, managing your finances has never been easier! Keep track of your current accounts and cards, purchase new products with just a few taps, set reminders for important deadlines, and access all your documents on the go. The app's intuitive design and user-friendly interface make navigating through your daily financial tasks a breeze. Plus, with the added convenience of Fingerprint access for compatible devices, you can enjoy a seamless and secure banking experience. Say hello to a smarter way of managing your money with the Hello bank! App.

-

BankID security app

BankID security app

BankID Security App is a vital tool in maintaining secure access to personal identification on mobile devices. Developed as part of the Mobile BankID system, this app is supported by leading financial institutions such as Danske Bank, Nordea, and Swedbank. With BankID Security App, users can securely authenticate their identity while accessing a wide range of services provided by participating organizations. Compatible with Android 6 and newer devices, this app ensures reliable protection for users’ personal information. For more information on how BankID Security App can enhance your mobile security experience, visit www.bankid.com/rp/info.

-

WikiFX-Broker Regulatory APP

WikiFX-Broker Regulatory APP

WikiFX-Broker Regulatory APP is your go-to app for all things forex trading. With up-to-date information on over 40,000 brokers, including regulation, license, and risk exposure, you can rest assured that you are making informed decisions. The app also offers real-time market data, news updates, and a social component where you can interact with other traders. Whether you are a seasoned trader or just starting out, WikiFX has got you covered. And with features like field surveys and relationship diagrams, you can easily spot and avoid fake brokers. Download the app today and take your trading to the next level.

-

World Mobil

World Mobil

World Mobil is a versatile app that offers a wide range of features to make your financial transactions easier and more convenient. With the Opportunities menu, you can easily access campaigns and special offers, track your earnings, and participate in campaigns with just a tap. The My Earnings menu allows you to manage your credit card transactions, view earned points, and transfer points between cards. The World PAY menu enables seamless purchases through QR code or NFC mobile payment, making transactions effortless. With a global deployment strategy focusing on phased rollouts and localized solutions, World Mobil is committed to providing tailored solutions for customers worldwide. Additionally, features like My Cards, Card Tracking, and My Profile offer further customization and control. Download World Mobil now and experience a new level of financial convenience tailored to your needs.

Popular

-

127.40MB

-

22.02MB

-

36.60MB

-

52.20MB

-

63.40MB

-

727.70MB

-

8112.40MB

-

910.50MB

-

1012.14MB

VPN

VPN

Comments